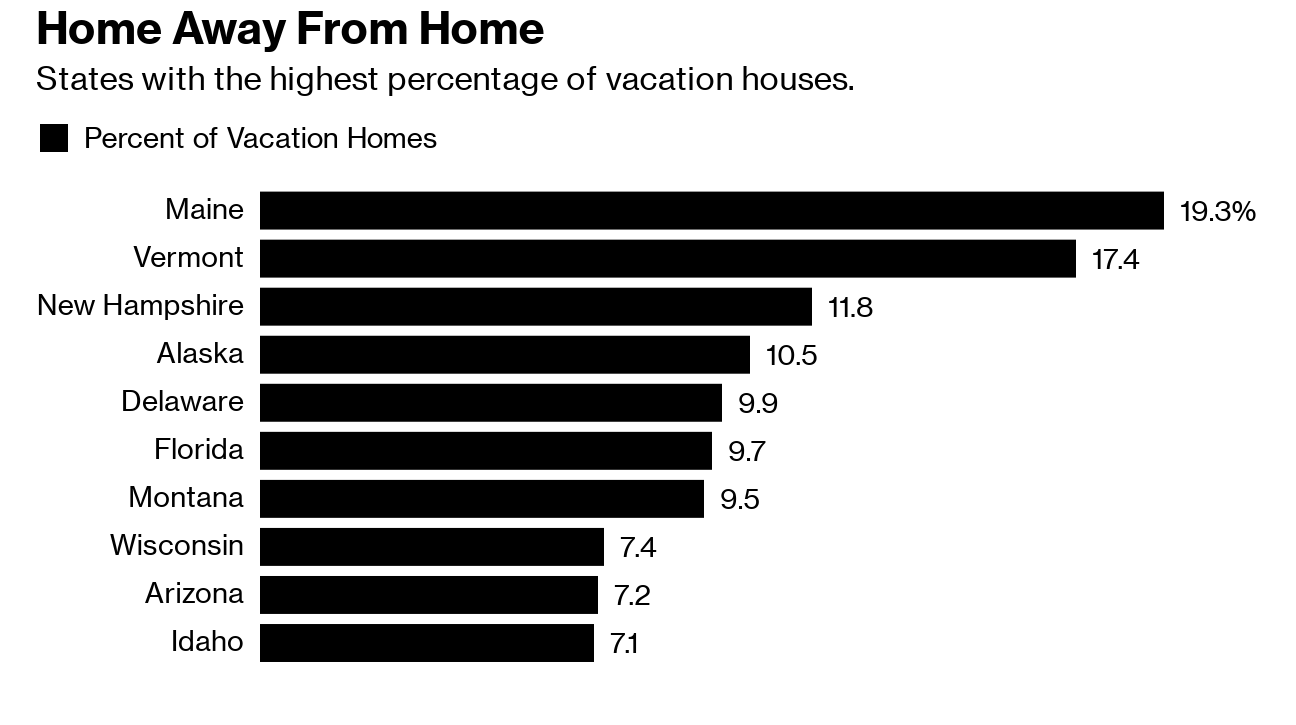

Vacation Homes in Maine

A guide for success

Beyond their primary residence, many investors choose to invest in a vacation home, not only for leisure but also as a smart investment for their future retirement. The great news is that owning a vacation home can offer some significant financial advantages. You can take advantage of tax deductions on property taxes and interest payments. Plus, during the off-season, you have the option to rent out your property for additional income. If you spend less than 14 days a year in your vacation home, you can even claim depreciation on it.

However, it’s important to understand the guidelines for a property to be considered a second home. You are typically allowed to own up to two second or vacation properties. Owning more than two might classify your properties as investment properties, potentially affecting your tax benefits.

Everything you can imagine is real.

At Maine Home Connection, we channel our unwavering commitment and passion into delivering unparalleled real estate excellence.

If you’re contemplating a real estate transaction, seize the opportunity to empower your decision with our most current Buyer or Seller guides.

Imagine More!