1031 Tax Deferred Exchange

Understanding Maine requirements

Understanding Maine requirements

1031 Exchange

Maine requirements

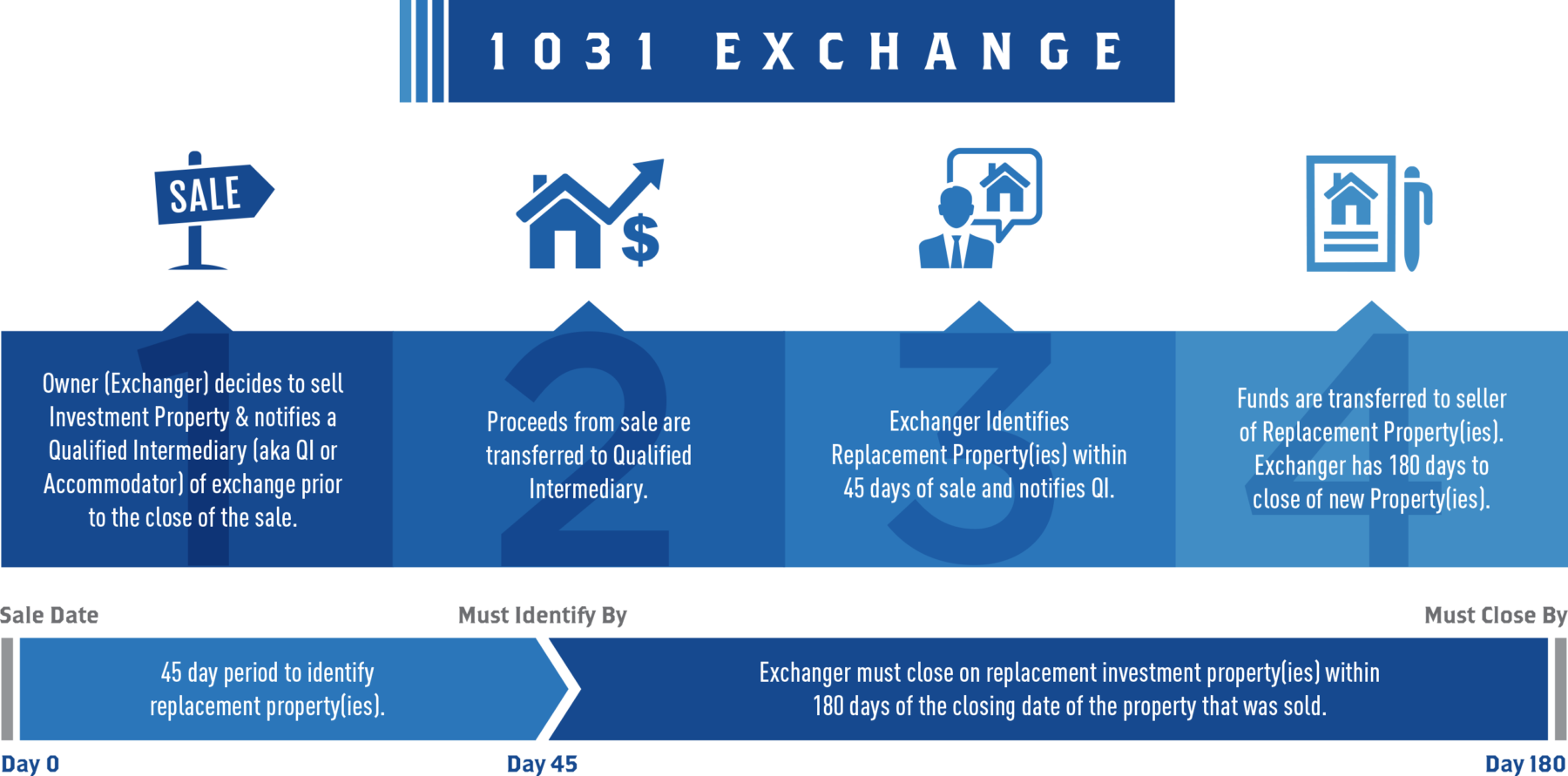

A 1031 tax-deferred exchange stands as a formidable financial strategy, particularly valuable for individuals immersed in the realm of business or investment real estate. This mechanism offers a unique opportunity to orchestrate a financial maneuver that seamlessly facilitates the transition of the proceeds gained from the sale of a property into the acquisition of one or multiple analogous investment properties, all while providing a significant advantage: the deferral of capital gains taxes.

This deferral aspect is a game-changer. Ordinarily, when you sell a property and realize a profit, you are subject to capital gains taxes on that profit. However, the 1031 exchange allows you to sidestep this immediate tax liability, essentially preserving and reinvesting your hard-earned gains for future growth.

Everything you can imagine is real.

At Maine Home Connection, we channel our unwavering commitment and passion into delivering unparalleled real estate excellence.

If you’re contemplating a real estate transaction, seize the opportunity to empower your decision with our most current Buyer or Seller guides.

Imagine More!